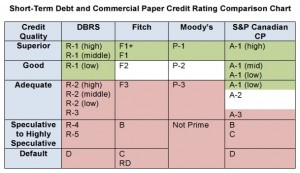

By: Brian Koscak, Alison Manzer, Jonathan Fleisher and Michael Brown The Canadian Securities Administrators (the CSA) have published for comment proposed amendments (the 2014 Proposals) to National Instrument 45-106 Prospectus and Registration Exemptions . The 2014 Proposals seek to amend the existing prospectus exemption for short-term debt securities by imposing different credit rating requirements and […]