On March 20, 2014, the Alberta Securities Commission (the ASC) published statistics about the use of the offering memorandum exemption in s. 2.9 of National Instrument 45-106 Prospectus and Registration Exemptions (the OM Exemption) for the Province of Alberta.This provides useful data, albeit Alberta-only data.

The key statistics below are taken directly from Annex B Background – Local Experience with OM Exemption from Multilateral CSA Notice of Publication and Request for Comment Proposed Amendments to National Instrument 45-106 Prospectus and Registration Exemptions Relating to the Offering Memorandum Exemption and in Alberta, New Brunswick and Saskatchewan, Reports of Exempt Distribution.

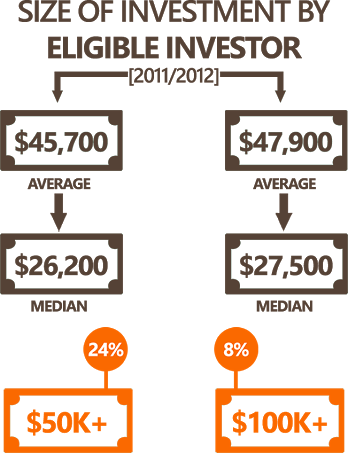

The following sets out the observations by ASC staff on use of the OM Exemption in Alberta. The infographic was added to provide a visual representation of the data.

1. “The OM Exemption is the second most frequently used “capital-raising” prospectus exemption in Alberta (41% of distributions in 2012 were made under the OM Exemption) although the value of the securities distributed ($0.5 billion in 2012) was 3.8% of the total.”

2. “The exemption is used almost exclusively by non-reporting issuers.”

3. “77% of the 287 issuers raising money in Alberta in 2011 and 2012 under the OM Exemption were Alberta-based.”

4. “In 2011 and 2012, there was approximately $824 million raised by 223 Alberta-based issuers under the OM Exemption. Approximately 155 or 70% of issuers self-reported their industry category as real estate or mortgage-investment corporations (MIC). These real estate and MIC issuers raised 76% of the total amounts raised by Alberta-based issuers under the OM Exemption.”

5. “Of the purchasers under the OM Exemption in 2011 and 2012:

- 90.5% were individuals;

- 5.9% were corporations;

- 1.7% were limited partnerships; and

- 1.6% were trusts”.

6. “Approximately 61% of the individual investors made at least one purchase in an amount greater than $10,000, suggesting, assuming compliance, that they qualified as “eligible investors”. These purchases represented approximately 90% of the total value of purchases by individuals.”

7. “Approximately 39% of the individual investors purchased in amounts not exceeding $10,000. These individuals may or may not be eligible investors.”

8. “The average size of an investment by an individual investor (assumed to be an “eligible investor” because of an investment of more than $10,000) in 2011 and 2012 was approximately $45,700 and $47,900 respectively, while the median was approximately $26,200 and $27,500 respectively. (These amounts were higher for non-individuals.) Approximately 24% of eligible investors purchased more than $50,000 and approximately 8% purchased more than $100,000 per year. The following is a further breakdown of the total number of individuals that invested in 2011 or 2012 $50,000 or more in a single year under the OM Exemption:

- 1773 individuals invested between $50,000 and $99,999;

- 816 individuals invested between $100,000 and $249,999;

- 122 individuals invested between $250,000 and $499,999; and

- 26 individuals invested in excess of $500,000.”

9. “The ASC has received numerous complaints from investors that have invested significant amounts under the OM Exemption and incurred significant losses.”

10. “While approximately 68.7% of individuals made only a single investment over 2011 to 2012, the following % of individuals made multiple purchases:

- 20% made 2;

- 5.6% made 3; and

- 5.8% made 4 or more.”

11. “Where individuals made multiple purchases, their average and median investment, not surprisingly, increased as well.”

12. “Of investors who only invested in amounts of less than $10,000 (and may be non-eligible investors) 10% in 2011 and 17% in 2012 made repeat purchases resulting in their total investment exceeding $10,000. Typically the total investment was less than $25,000 but approximately 111 investors who invested less than $10,000 per distribution invested in total from $25,000 to $100,000 within a calendar year.”

13. “There are a few issuer groups raising the majority of the funds under the OM Exemption in Alberta. Some of these large issuers have “in-house” exempt market dealers selling the securities on their behalf.”

* * *

Disclaimer

This blog is not intended to create, and does not create an attorney-client relationship. You should not act or rely on information on this blog post without first seeking the advice of a lawyer. This material is intended for general information purposes only and does not constitute legal advice. For legal issues that arise, the reader should consult legal counsel.

Brian Koscak is a Partner at Cassels Brock & Blackwell LLP located in Toronto, Ontario and Chair of the Private Capital Markets Association of Canada (formerly, the Exempt Market Dealers Association of Canada). Brian is also a member of the Ontario Securities Commission’s Exempt Market Advisory Committee and Co-Chair of the Equity Crowdfunding Alliance of Canada. Brian can be reached by phone at 416-860-2955, by e-mail at bkoscak@casselsbrock.com or on twitter @briankoscak. Brian also regularly writes about Canadian securities law matters on his personal blog at www.briankoscak.com.

Brian Koscak is a Partner at Cassels Brock & Blackwell LLP located in Toronto, Ontario and Chair of the Private Capital Markets Association of Canada (formerly, the Exempt Market Dealers Association of Canada). Brian is also a member of the Ontario Securities Commission’s Exempt Market Advisory Committee and Co-Chair of the Equity Crowdfunding Alliance of Canada. Brian can be reached by phone at 416-860-2955, by e-mail at bkoscak@casselsbrock.com or on twitter @briankoscak. Brian also regularly writes about Canadian securities law matters on his personal blog at www.briankoscak.com.

Speak Your Mind

You must be logged in to post a comment.