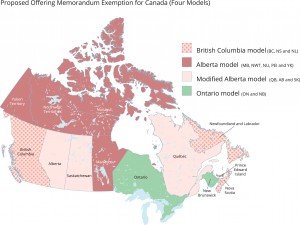

Word cloud image for the Offering Memorandum Exemption in Canada. The offering memorandum exemption is a prospectus exemption that is available across Canada except Ontario where it is currently under consideration by the Ontario Securities Commission. Certain other jurisdictions in Canada are also looking at changing the offering memorandum exemption by, for example, introducing a […]