On March 20, 2014, the Ontario Securities Commission (the OSC) published for comment a long awaited proposal for a new offering memorandum exemption in Ontario based on a variant of the Alberta model as set out in Section 2.9 of National Instrument 45-106 Prospectus and Registration Exemptions (the OM Exemption). On the same date, Canadian […]

Part I – Offering Memorandum Exemption Finally Proposed in Ontario! Other Regulators Also Mulling Changes

Misrepresentations in a Private Placement Offering Memoranda in Canada

By Brian Koscak and Alixe Cormick An offering memorandum (OM) must contain all information material to the investment opportunity to enable an investor to make an informed investment decision. What information is material depends on the specific business and investment opportunity of an issuer. Under Canadian securities laws, an issuer must ensure there is no […]

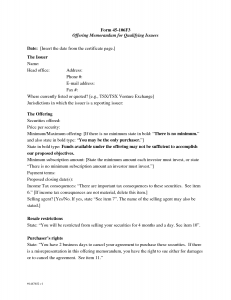

The Offering Memorandum Exemption in a Nutshell

By Brian Koscak and Alixe Cormick The offering memorandum exemption (the OM exemption) in Section 2.9 of National Instrument 45-106 Prospectus and Registration Exemptions (NI 45 106) allows issuers to sell to anyone regardless of their income, net worth, investment amount, or relationship to the principles of the issuer. Everyone an issuer could solicit in […]

Ontario Offering Memorandum is NOT the Same as the Offering Memorandum Exemption

By Brian Koscak and Alixe Cormick The term “offering memorandum” has two meanings under securities laws in Canada. In Canadian jurisdictions other than Ontario, an offering memorandum is a document prepared in the prescribed form under National Instrument 45-106 Prospectus and Registration Exemptions (NI 45-106 OM) to enable an issuer to rely on the offering […]

A ‘Second Set of Eyes’ -Voluntary Pre-Filing Review of Offering Memoranda by Canadian Securities Regulators

By Brian Koscak and Alixe Cormick Preparing an offering memorandum (an OM) is no easy task. An issuer does not want to miss a form disclosure requirement or make a misrepresentation in its OM when raising capital under section 2.9 of National Instrument 45-106 – Prospectus and Registration Exemptions (commonly referred to as the OM […]